#97 Blackrock, black clouds and Bitcoin: a few hiccups don't stop the run

ETF inflows slow down, Ethereum is under scrutiny, but Bitcoin, Maker, Botto and also Blackrock continue "buidling".

Crypto has been experiencing some small setbacks lately, but remains adamant in its optimism. ETF inflows saw a hiccup, and while we're not quite back to our usual flood, signs of recovery are beginning to emerge. The Federal Reserve decided to delay rate cuts, holding back liquidity that could potentially otherwise end on-chain. Ethereum’s ETF is less certain these days after some rumors of regulatory scrutiny.

But the bull run is out of the question. BTC recovered from a temporary drop of over 15% and is back on its way up, and even Ethereum, with darker clouds looming, feels in shape.

The two antithetical forces of memecoin gambling from within and institutional interest from outside continue to play. Solana got memecoin drunk in the last weeks, while Blackrock stepped into Ethereum with a fund that will potentially tokenize real-world assets. Their fund was aptly called BUIDL, which is what many people remain committed to doing. In this issue we go through the current stages of Maker, Botto, and also of Bitcoin, rediscovering itself as an ecosystem.

Ethereum is under scrutiny

While Ethereum emerged as a secondary play following Bitcoin ETF approvals, doubts about the likelihood of an Ethereum ETF approval have intensified. Despite initial optimism surrounding the Dencun upgrade aimed at reducing transaction costs and expanding Ethereum's utility, concerns have mounted due to regulatory silence and rumors of impending scrutiny from US authorities.

Amidst calls from US senators to halt future crypto-based ETF approvals and reports of SEC investigations into Ethereum's classification as a security, the crypto community remains on edge.

Industry giants like Grayscale and Fidelity have submitted changes to their ETF designs, looking for better odds at approval, but the regulatory landscape remains murky. While Ethereum's status as a security seems unlikely given the oversight by the Commodity Futures Trading Commission (CFTC) and the SEC's historical difficulties in substantiating claims, pressure from the Biden administration may compel regulatory authorities to take a more assertive stance.

Read more about the current situation surrounding Ethereum: https://medium.com/carbonocom/ethereum-faces-uncertainty-as-etf-approval-prospects-dim-amid-regulatory-pressure-c594efc627fb

Bitcoin as an ecosystem

Unrelated to the recent surge in Bitcoin's price driven by ETF expectations, a transformative narrative unfolds within the Bitcoin ecosystem. Traditionally known for its simplicity and focus on asset transactions, the introduction of Ordinals and inscriptions has revolutionized the Bitcoin blockchain. Ordinals, facilitated by upgrades like Segwit and Taproot, uniquely number each satoshi and enable the appending of arbitrary data to them. This innovation has sparked a wave of creativity, leading to the emergence of NFTs, fungible tokens akin to Ethereum's ERC-20 (such as BRC-20) and a thriving ecosystem of Layer 2 solutions like Stacks and Rootstock.

Bitcoin, long regarded as the dominant force in the crypto space, is witnessing renewed developer enthusiasm as innovations from other chains are being adapted to its robust infrastructure.

While this trend holds promise for creating a more sustainable economy atop Bitcoin, driven by new services paying miner fees, it also introduces new challenges such as security risks and regulatory uncertainties. Moreover, this evolution transforms Bitcoin from a digital gold narrative to a productive asset with clear utility as the foundation of an expanding ecosystem.

A few of the L2s growing the scalability layer of Bitcoin (

https://l2.watch/

)

Blackrock continues digging roots in crypto

BlackRock, leading global asset management firm, has recently filed with the Securities and Exchange Commission (SEC) to establish a new fund known as the Blackrock USD Institutional Digital Liquidity Fund. The fund's name spells out the acronym BUIDL, a playful nod to the cryptocurrency community created by altering the spelling of "build."

The filing highlights the involvement of Securitize, a company specialized in asset tokenization, suggesting a strategic partnership or role in the fund's operations.

Based on on-chain data analysis, it has been revealed that the fund operates on the Ethereum blockchain and has been initially funded with a substantial amount of $100 million in USDC stablecoin.

Tokenization continues to gain momentum as a core trend in the cryptocurrency space. It involves the creation of blockchain-based representations of traditional assets, enhancing their liquidity and efficiency. Larry Fink, Blackrock’s CEO, has praised the benefits of tokenization in the past. This move is consistent with the recent strategic positioning of Blackrock in the crypto space, with the launch of a highly successful spot bitcoin ETF, the filing of a spot ETH ETF, and now this.

Maker’s Endgame approaches

Maker is one of the oldest and most reputable crypto organizations and, at the same time, one of the most innovative.

Maker is responsible for managing DAI, one of the first stablecoins, currently with $4.78B in circulation. DAI has been tweaking its design over the years, according to market trends and needs, in aspects such as its collateralization: originally backed only by crypto, it moved to being collateralized mostly by USDC, until the Tornado Cash crisis showed the risks of centralization, which led them to another move towards diversification and decentralization.

But Maker is also one of the most innovative crypto organizations. The DAO governing the protocol has pioneered the onboarding of Real World Assets to crypto, and has launched successful spinoffs, such as Spark, their incursion into the lending sector.

Maker’s Endgame is the ambitious roadmap that the DAO has established to become a stronger and leaner organization. It involves a strong rebranding process, which includes revamping Maker’s native token, MKR, and the stablecoin DAI. In the following steps, the Endgame roadmap will involve the launch of a number of SubDAOs that will assume portions of the protocol governance, each of them with their own native token (expect airdrops and subsequent buzz). The final act of the Engame plan is the launch of Maker’s own blockchain.

The Endgame plan has been floating around for a few months now, but it has been back on the table since last week.

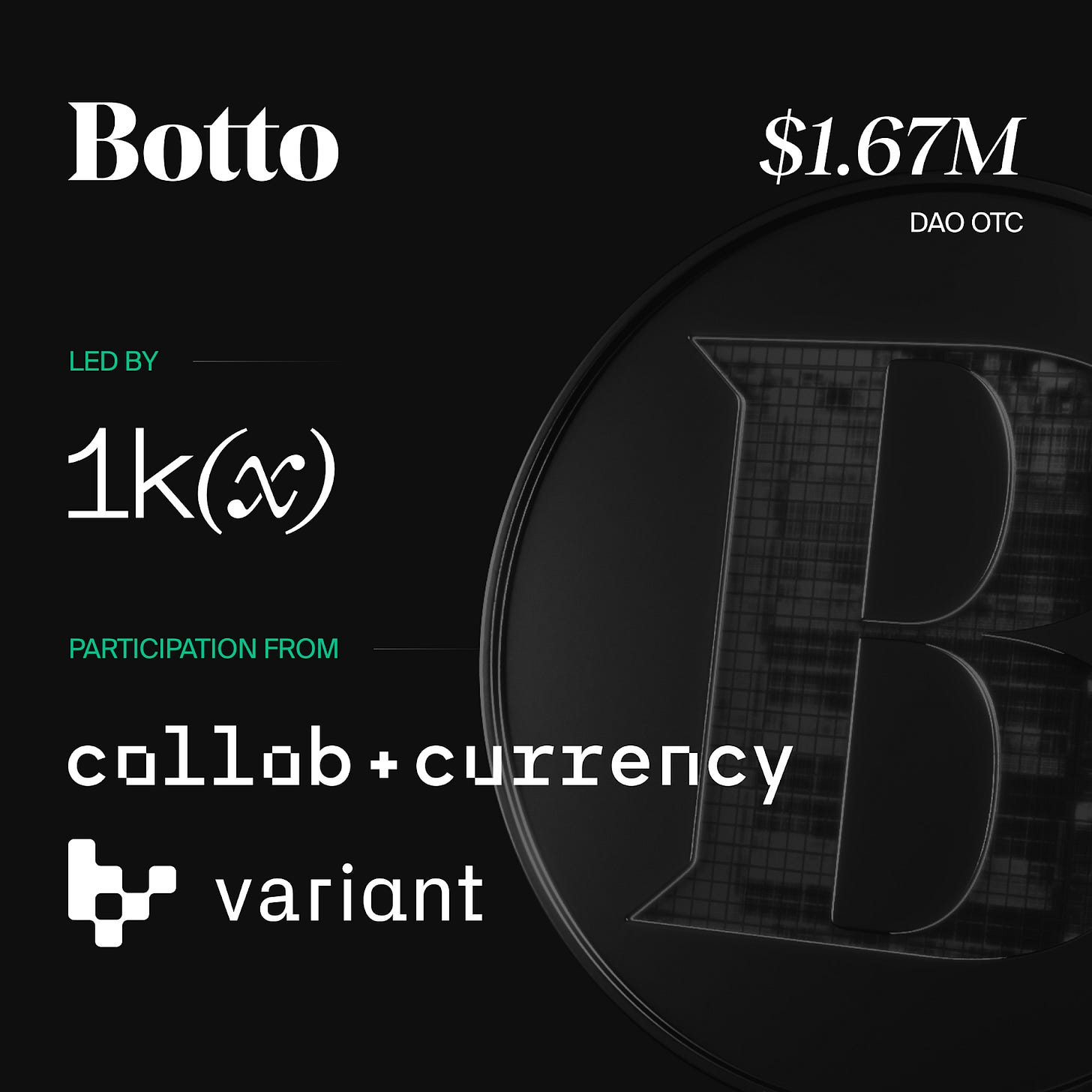

Botto - Fueling Creativity with $1.67M Boost

Botto, the decentralized autonomous artist, has successfully closed a funding round, securing $1.67 million through treasury over-the-counter (OTC) transactions. Led by investors 1kx, Collab+Currency, and Variant Fund, this funding will accelerate Botto's development across technical, creative, and marketing fronts. While primarily an art project, Botto has emerged as a notable player in the AI and crypto spaces, exemplifying the convergence of technology and artistic expression.

Unlike other AI tokens, Botto is an exploration of the unknown, which invites audiences to engage with its creations, enjoy the journey and learn.

A recent example of Botto's innovative approach is its 13th mint, where AI entirely dictated the selection of the winning fragment, showcasing its commitment to pushing creative boundaries.

This funding round paves the way for Botto to further enhance its capabilities, with initiatives such as advanced learning models (LLM) and decentralized governance frameworks on the horizon. Excitement abounds for Botto's continued evolution at the forefront of human-AI collaboration in the decentralized world.

EU regulation misunderstanding causes panic

The recent panic surrounding the European Union's purported ban on anonymous crypto payments and self-custodial wallets stemmed from misinterpreting the Anti-Money Laundering Regulation (AMLR). While reports circulated about the EU prohibiting cash transactions exceeding €10,000 or anonymous transactions beyond €3,000, it's essential to clarify that these regulations are not specific to cryptocurrencies. Instead, they fall under a broader framework to combat money laundering and terrorist financing.

Crypto exchanges and custodial wallet providers in the EU have been operating under similar obligations outlined in the current Anti-Money Laundering Directive (AMLD5). While the AMLR may introduce some refinements or adjustments, its core principles remain consistent with existing measures. Therefore, the widespread panic and misconception regarding the EU's stance on anonymous crypto transactions and self-custodial wallets are unfounded, as these regulations primarily target financial institutions and entities prone to AML/CFT risks rather than individual users or decentralized technologies.