#33 To be or not to be a security

The SEC slips in a very important statement about tokens in an insider trading case. Also, scalability gets a boost, the state of the Merge and Dubai goes meta.

To be or not to be a security.

The question of whether cryptocurrencies are securities or commodities (or another type of asset, for that matter) does not have a final answer yet. However, it has been on the table for a long time.

Commodities are interchangeable goods, and securities are financial assets, in a dangerously short definition. Putting a label on cryptocurrencies has significant implications, which is probably one of the main reasons regulators haven’t tackled the issue yet. Calling them one thing or the other would mean instantly applying to cryptocurrencies existing regulatory frameworks and assigning oversight to current public institutions -and neither the frameworks nor the institutions are ready yet to take on that task. Plus, regulating crypto has always been tricky. It is an industry with great potential, both for good and for evil, and even though regulators want control over it badly, they don’t want to go too far and scare it away to another country.

Yet, things took an interesting turn lately, in a Trojan horse of an indictment by the SEC.

Coinbase is a centralized exchange. This means that it is their prerogative to decide what cryptocurrencies are available for trade on their platforms, something that, given the size of the customer base, is a game changer for any project. If you were to launch a token, you’d pray to the gods of crypto that it caught the eye of Coinbase. Getting listed means validation, massive brand awareness, and price spikes.

A former Coinbase product manager allegedly used the information he had access to, thanks to his position, to front-run Coinbase’s listings and make some money from it for him, his brother, and a friend. They would purchase tokens they knew were about to be added to Coinbase, and they’d sell them right after the official announcement to make a profit from the sudden increase. The investigation mentions more than $1M in profits from the scheme.

This is called insider trading in TradFi jargon and should be called the same in crypto. It is a crime in TradFi, and it should be treated as such in crypto too. But that’s not the point here.

The Coinbase product manager and his friends have been accused by the Department of Justice and the Securities Exchange Commission. But while the DOJ has made a case for “wire fraud conspiracy and wire fraud,” the SEC has added that there was securities fraud involved because 9 of the 25 tokens involved happen to be, according to the SEC, unregistered securities.

The SEC has never discussed or disclosed any criteria to consider a cryptocurrency a security. They have never formally declared where the limits are or requested the industry for input or registration. The only frame of reference to discern securities comes from a 1946 Supreme Court Case that established what is now known as the Howey test: a vague (albeit useful) declaration of what constitutes a security. The Howey test is just a verbalization of what constitutes a security. If an asset resembles this definition, it will be considered a security:

"The investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

There is no doubt that many cryptocurrencies fall within this description. A gazillion tokens meet the four conditions of the Howey test. In fact, some regulators have claimed, although only informally, that it’s likely that only Bitcoin and Ether are excluded from the definition. But nobody has yet provided any clear guidelines for projects to comply with.

This is why the SEC’s behavior is considered treacherous by the industry. The regulator slid such a bold statement in the middle of an accusation without further explanation or right to reply. The nine tokens identified as securities in the case do not even have a voice in court because they have not been called as defendants; their condition as securities has been stated as a premise without any option for dialogue. This is what smart people call “regulation by enforcement”. Instead of taking the time to outline the rules clearly, rules will have to be abstracted from the SEC’s policing activities. As a result, crypto companies cannot know what laws will apply to them in a court appeal.

Read Jake Chervinsky, one of crypto’s most prominent lobbyists,

⬡ Six Angles

We select six topics to illustrate the very different angles crypto can be approached from. We could choose dozens, but six is the atomic number of carbon… and otherwise we’d be writing for ages.

1. Scalability | ZK rollups are on a roll

Last week crypto was surprised by a trio of big announcements from Scroll, Matter Labs, and Polygon. They all publicized the upcoming launches of their respective takes on zk-rollups, one of the most wanted improvements to Ethereum’s scalability that nobody expected to happen any time soon.

You probably know:

That Ethereum has a big problem with scalability. Transactions at the moment are expensive and often slow (or slow unless you can pay an expensive price), and a big NFT drop is enough to make prices skyrocket for everybody. Imagine that the launch of a new iPhone made everyone’s Venmos expensive.

That Ethereum is about to wrap up one of its most critical technical upgrades, The Merge, and some people mistakenly believe that this will improve Ethereum’s throughput. Scalability was not on the table on this occasion.

That Ethereum developers have been saying for years that the future of scalability, at least in the mid-term, is in rollups - layer 2 implementations that process and bundle transactions and then add them to the mainnet.

Layer 2 scalability solutions come mainly in two flavors: there are optimistic rollups and the zk-rollups. Optimistic rollups are already out there, with Arbitrum and Optimism as the two most prominent projects delivering great numbers. Zk-rollups were not expected yet. They pose bigger technical challenges that were presumed to slow down the development. Yet these three projects, coincidentally, have announced upcoming launches that will rock the foundations of the Ethereum ecosystem.

Layer 2 summer is about to happen…probably by winter 2022 or early 2023.

2. Ethereum | The state of the Merge

Before we got mauled by a bear, we naively stated that Ethereum’s Merge would be the most crucial development of the year in crypto. We remain excited. Price action is a short-term concern, while The Merge is one giant step for crypto-kind. We’re talking about a technical upgrade that will change Ethereum’s validation method from Proof of Work, the impopular energy-binging protocol, to a friendlier Proof of Stake. The transformation also drastically affects some financial fundamentals, like the emission of new tokens and the mining incentives.

Vitalik Buterin says The Merge will take Ethereum’s vision to a 55% completion. The upgrade is expected to happen next month (September) as all the successive rehearsals have been successfully deployed.

3. Corporate adoption| Tesla sells their Bitcoin

Back in January 2021, Tesla bought $1.5B bitcoin to become part of their treasury. Elon Musk promoted this experiment in corporate adoption of bitcoin while at a peak of his rollercoaster of crypto enthusiasm.

Shortly after, Tesla sold 10% of its bags to test liquidity. And last week, they converted approximately 75% of their Bitcoin purchases to fiat, adding $936M of cash to their balance sheet.

In January 2021, Tesla’s move was considered one of the corporate world’s most important endorsements in crypto history. Today, Musk claims to remain faithful.

“We are certainly open to increasing our Bitcoin holdings in the future,” Musk said, “so this should not be taken as some verdict on Bitcoin. It’s just that we were concerned about overall liquidity for the company, given COVID shutdowns in China. And we have not sold any of our Dogecoin.”

4. Gaming | Minecraft bans NFTs

Minecraft, the gaming revolution created by Mojang, now owned by Microsoft, recently turned its back to crypto. Gaming seems to be one of the hottest battlefields of Web 3 adoption. While many companies consider NFTs and tokens a miracle that will push the industry to new heights, many (studios and players) aggressively reject the interference of NFTs in their business.

According to their public statement, “the speculative pricing and investment mentality around NFTs takes the focus away from playing the game and encourages profiteering, which we think is inconsistent with the long-term joy and success of our players.”

Fair enough.

On the other hand, Minecraft is closing the doors to the unlimited creative power of fairly incentivized participants, able to bring innovations beyond anyone’s imagination.

5. Credit Crisis | Three Arrows Capital

Sun Zhu and Kyle Davies, the founders of Three Arrows Capital, recently emerged from the shadows to share their perspective on the crisis. They had been virtually AWOL since early June, when a brief tweet from Zhu confirmed everyone’s fears that they were underwater and, to the chagrin of debtors and business partners, they stopped returning anybody’s calls.

The two founders confirmed an excess exposure to the Terra collapse (which left them a hole of at least $500M) and admitted they had been led by overconfidence to several bad decisions.

The full consequences of their collapse are still unfolding.

6. Web 3 | Dubai jumps into the metaverse

Dubai, the capital of one of UAE’s 7 emirates, known for its architectural and financial exuberance, is now looking at the virtual side of life.

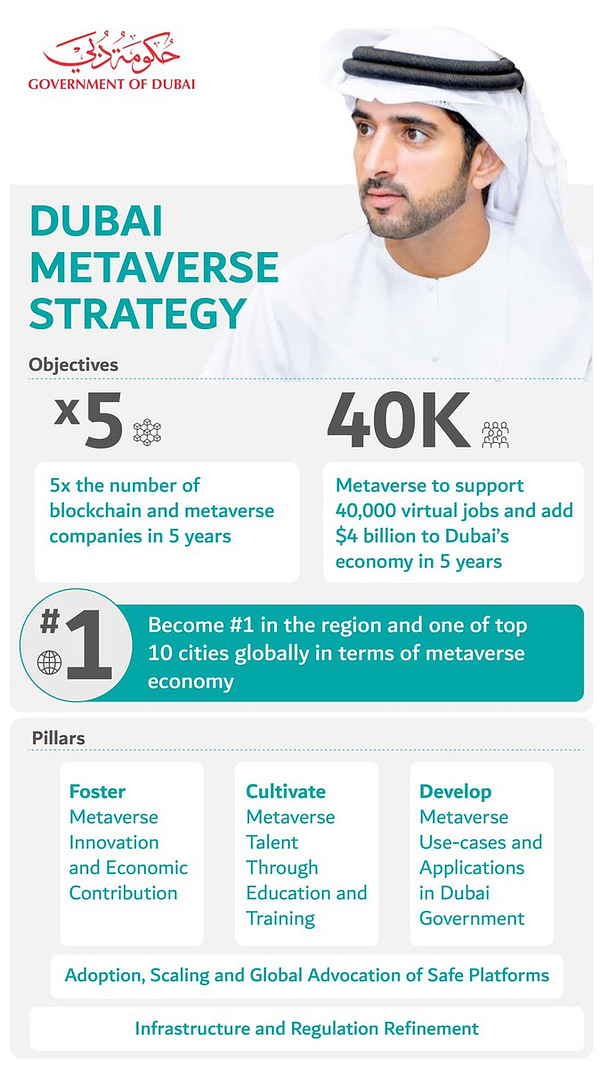

The Dubai Metaverse Strategy, launched on Monday, aims to attract more than 1,000 blockchain and metaverse companies to the city as well as support more than 40,000 virtual jobs by 2030

This is another step in the path of crypto adoption in the emirate. Dubai has already attracted the attention of companies like Crypto.com, Bybbit, Binance, and FTX. They have obtained licenses or opened offices there following the friendly regulatory stance from the authorities.

Was it useful? Help us to improve!

With your feedback, we can improve the letter. Click on a link to vote: