#18 Web3 brawl, Apes VS Punks, and the inevitable end of the year recap

There was a fight over decentralization that we use to dive into the concept. Also, the unavoidable yearly recaps and a story of competing NFTs.

Decentralization wars

Last week’s crypto-Twitter felt a little bit like wlaking through Tokio in a Godzilla movie. We are all used to our share of screen conflict, but this time it was starred by some of the biggest names in the space.

Jack Dorsey, Elon Musk, Balaji Srinivasan, Chris Dixon, Marc Andreessen, Erik Voorhees, Tyler Winklevoss jumped into it. We could even include Cardi B as part of the brawl because a brief exchange between her and Jack preceded the start of the fight. Coincidence?

Drama aside, the discussion revolves around the most relevant concept in crypto: decentralization. So let's break things down a little bit and use this anecdote as a gateway into this crucial principle.

The rant

It all started when Jack Dorsey criticized the direction Web 3 is taking. According to Dorsey, the whole concept of Web 3 is a gimmick to fool people into believing they have power over the design of the new Internet.

What seemed like an abstract take against VC’s insatiable appetite for Web 3 startups became personal in a reply to Elon Musk with a not-so-veiled reference to Andreessen Horowitz (aka’d A16Z). Andreessen Horowitz launched a $2.2B fund in June, has invested in over 50 companies so far and has hired virtually everyone in the crypto startup space.

A while later, he RTd this self-explanatory cartoon

Then, in case someone still didn't know what he meant.

Finally, he summarised all his views in this last tweet

The concept

What exactly are we fighting about?

Web 3 is still an ambiguous concept that refers to a new iteration of internet technology based on decentralized ownership and transfer of value. The term references Web 2.0, the title given to the technologies that changed the role of end-users on the Internet in the early 2000s. And where there's a 2.0, there must be a 1.0.

Web 1.0 refers to the initial iterations of the Internet, where the protocols allowed for the transmission of information, like through email or basic web navigation - an era characterized by open-source tech that many entrepreneurs used as the building blocks for new products and services.

Web 2.0 encompasses the technologies that allowed the end user to become a content producer, which created new ways in which content was generated, distributed and consumed. It was eventually dominated by proprietary platforms turned into monumental corporations that became great at extracting value from the community: the end user produces the content and interactions, developers builds a whole industry around these platforms, dependant on these platforms, but it's these big corporations who reap most of the benefits.

Web 3.0 evolves over the foundations of web 2.0:

It expands what can be generated and transmitted: from information to value. In Web 3, what users can create and share, goes beyond messages and enters the realm of digital property.

It decentralizes value and rewards. While 2.0 was the era of the Internet of platforms, where companies like Google or Facebook provided the platform and extracted the value, web 3.0 platforms are decentrally owned and governed, and value is distributed between stakeholders.

At least that's the theory. Jack disagrees.

The meat of the story

Decentralization is a key component of crypto. It is the great conceptual leap that will take internet to the next level, because it dramatically changes the incentive structure.

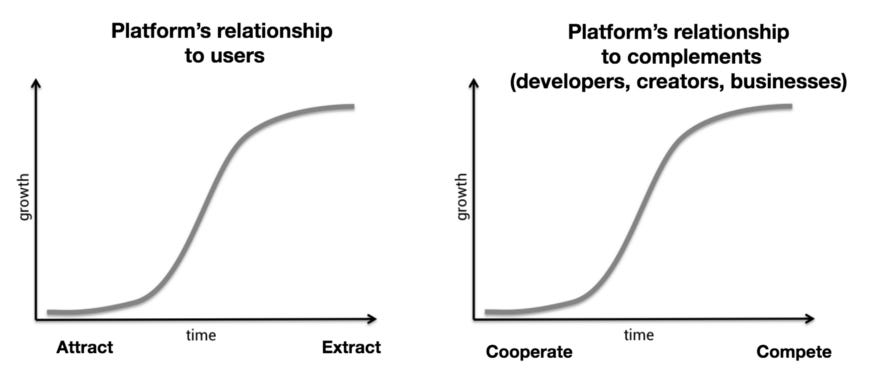

Even Chris Dixon himself, a GP in Andreessen Horowitz, has written one of the most accurate explanations on how this structure works. Web 2.0 platforms initially behave as neutral protocols that the community can use and build on. This is how Dixon describes the timeline between attraction and extraction of value from users and cooperation and competition against other ecosystem builders.

Jack's point is that when Dixon says "web 2.0", he should say "VC backed companies" instead. He claims that Web 3 will be following the same path as long as the economic incentives of investors are so central to the development of the trend.

Crypto is currently experimenting with new ways of distributing value and cooperating in an agile, profitable, and fair manner. Play-to-earn, DAOs, DeFi, are all different routes into this hypothesis. And even though the debate is complex and full of nuance, and no one should take a position based only on a set of tweets, Jack is correct in pointing out the importance of decentralization as a transformative force. So let's just let that sink in and not lose sight of it.

⬡ Six Angles

We select six topics to illustrate the very different angles crypto can be approached from. We could choose dozens, but six is the atomic number of carbon… and otherwise we'd be writing for ages.

1. 2021 in review | Headlines that explain the year

We cannot escape the recap-mania that comes with the end of a year, so we wanted to gather the news that we considered that have defined the year, in just a few lines. We won't explain what happened (the links probably do a better job, if you don't know the story already), but we will point out why we think each one mattered.

Tesla buys $1.5B Bitcoin. (February). Elon Musk broke the ice for many institutional investors by making room for BTC in a big company's treasury. He also proved that one single person can have a profound impact on BTC prices. And finally, it brought the environmental concerns about Proof of Work back under the spotlight.

China bans crypto (May) and then bans it again (September). The Chinese regulatory stance on crypto has probably environmental reasons (China was worried about the carbon footprint and the lack of control over the energy industry Bitcoin mining was bringing) and also economic ones (BTC competed against the Chinese governmental digital currency -CBDC-, one of the most advanced in the world). The consequence was a sudden change in the power balance linked to mining, from a concentrated power to a more distributed design.

EIP-1559 was launched (August). In a trademark way of doing things, Ethereum took longer than initially announced but finally delivered a solid improvement. It took almost two years for EIP 1559 to come to life. Still, it finally happened and did what it said it would: it created a new monetary policy for Ethereum and redesigned the incentive structure for miners. Let's hope things look as good when Eth 2.0 happens.

Infrastructure bill (August). The bill itself might end up being just a footnote in crypto’s history, but we choose this event as the moment when the industry gathered around a political cause and discovered its true power. The ecosystem responded swiftly and consistently - it proved it could have a direct impact on the public agenda, trained its lobbying muscle, and opened new communication channels with public opinion.

El Salvador accepts Bitcoin as legal tender (September). El Salvador’s success in this adventure is still in dispute. So far, it has mainly been a big PR stunt from Nayib Bukele, but it could also be the beginning of something. We believe in incorporating crypto as a legal vehicle for official transactions, so we will be rooting for the country.

Bitcoin futures ETF approved (October). Even though future-based ETFs for Bitcoin are less profitable than mere HODLing, the opened the floodgates for more traditional investors to gain exposure to BTC, and also crossed a regulatory point of no return.

Facebook rebrands as Meta (October). We needed an NFT related headline to make it to our recap. This is definitely not the best, but Facebook's rebrand has the size we want. It is already a $10B effort by one of the biggest corporations in the world to pivot into a space where crypto will probably lead the way in areas such as digital ownership, identity, and interoperability.

2. NFTs | The flippening between BAYC and Cryptopunks

Oh, does crypto love a flippening. This term was coined to define the hypothetical future moment when Ethereum overtakes Bitcoin in value. This data-addict ecosystem is always looking for the moment when takeovers happen like we were watching a race.

Last week we witnessed a flippening. Bored Apes Yacht Club has been growing in relevance to the point that its floor price (the price of the cheapest of its assets) surpassed the floor price of Cryptopunks, until then, the clear #1 NFT collection of avatars in the hearts and minds of crypto.

The price of the cheapest Bored Ape NFT for sale is now 53.9 Ether (ETH), or $215,067, while the minimum asking price for a CryptoPunk is 52.69 ETH, which is currently worth $210,239, according to OpenSea. Bored Ape Yacht Club NFTs catch up to CryptoPunks, flips floor price

The recipe for BAYC’s success has many ingredients.

Celebrity sales: the startup MoonPay has specialized in helping celebrities purchase -and subsequently brag- Bored Apes.

A more lenient approach to copyright than their pixellated counterpart.

First-class partnerships with companies such as Universal or Adidas.

3. Marketing | Airdrops gone wild

We've spoken about airdrops before. They are one of crypto's most exciting marketing inventions. With crypto wallets being pseudonymous (publicly accessible and transparent, while still anonymous), anyone with the necessary skills can track who did what and interact with people through their public addresses, usually by dropping something in said wallets as a way of engaging new people with a project.

It's like giving out flyers in the street. Only the passersby of the street you chose are only people whose online activity you know (Solana holders, ENS users, BAYC owners…?), and instead of flyers, you give away tokens.

Christmas has been active in airdrops. It must be the festive spirit—only this time they are being used in a pretty hollow and absurd way.

OpenDAO airdropped their SOS token to people who have spent money on OpenSea transactions. The project lacks a roadmap, but it seems to have the purpose of acting as an unofficial token for OpenSea (the company has not reported any intentions of launching one)

Some days later, GasDAO launched their own airdrop. "The token was distributed to nearly 650,000 Ethereum users who had fulfilled certain on-chain parameters, including having spent over $1,559 in gas fees". The project has no product, no purpose, no nothing.

4 Blockchains | Terra

At a time when crypto is performing poorly, especially compared against the overly enthusiastic predictions made during the last ATH…

…there’s one project that is showing unprecedented strength: Terra.

Terra is an Ethereum alternative. A Layer 1 project for issuing algorithmic stablecoins and creating decentralized financial infrastructure. If it sounds hard to grasp, that’s because it is. Just take in a couple of things:

Terra is a blockchain of its own that specializes in financial services. In a possible future, the one that maximalists don't want to believe in, where different L1s will have survived by specializing in various tasks, Terra could be focused on stablecoins and DeFi.

Terra has a native token, LUNA, and a dollar-pegged stablecoin UST. UST is an algorithmic stablecoin; this means that it uses other cryptocurrencies -LUNA- and not other assets (like actual dollars, stocks, bonds…) to remain stable. UST has currently taken over DAI as the biggest algorithmic stablecoin by market cap.

It has also surpassed Binance Smart Chain and recently become the second blockchain by DeFi TVL (Total Value Locked, or the value of the assets locked in DeFi contracts), only behind Ethereum.

All the possible good news for Terra has concentrated in recent weeks, but apart from the buzz, there seems to be something interesting in this project.

5 Questions | Read this thread

Dan Abramov, a much-respected engineer from Facebook, gathered in a thread all the questions that popped into his head after a deep dive into crypto.

Dan approaches issues with candor but sharpness. Some of his questions might be too technical for a general audience, but most touch pressing concerns with simplicity: energy consumption, DAO or Web 3 signal VS noise, fees…

So if there's one thing you can casually read in a moment of distraction during a break from the remaining family gatherings and dinners, check out the thread and its responses.

6. Our wishes for 2022

We couldn’t escape the Christmas spirit, and we wrote something for the beginning of 2022 - call them our best wishes or new years' resolutions. They sound boring, but they are heartfelt. So this is what we wish for:

Decentralization. We’ve already covered this in the initial section of this newsletter, but decentralization is at the heart of most things we value in crypto. The way decentralization redesigns collaboration is the most radical innovation. Let's cherish it.

Scalability. This is going to be 2022's more critical technical challenge. Suppose blockchains are to become the new financial system, or the new Internet, for that matter. In that case, it must happen on top of a seamless infrastructure—our best hopes and wishes for the community of developers tackling this challenge.

Regulation. Yes, regulation: the time has come for the ecosystem to join forces with regulators and find common ground that takes us all into the next level of massive adoption and trust.

If you enjoyed this issue, don’t forget to share. Carbono Insights is also available in Spanish. Share your thoughts and comments with Carbono at team@carbono.com, or through Twitter: @carbono_com, @raulmarcosl and @mrubio